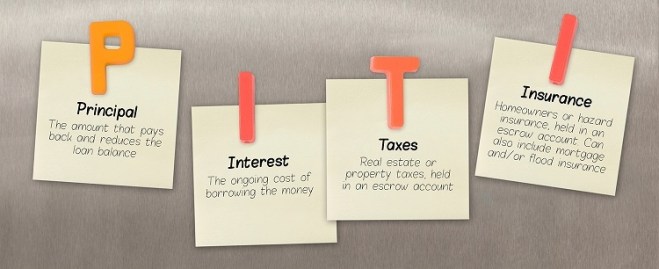

Every business has a learning curve and real estate is no different in this respect. You will get terms and acronyms thrown at you that you have never heard of before and it can be intimidating to ask questions when you think it is something you should know. So now that you are here, let’s discuss what PITI is…

What is PITI?

It is an acronym that stands for “Principal, Interest, Taxes, Insurance”. These four elements commonly make up a homeowners mortgage payment which is why they are often grouped together. When speaking with a mortgage lender or your real estate agent they may say “your PITI on this property if you buy it for $200,000 is $1500 per month.” They are basically telling you that your total payment per month at that price point is $1500 and are trying to sound fancy when they do so.

Principal

This is my favorite part of the PITI acronym because it is the only one that helps me grow wealth. Your principal payment gets applied directly to the money you borrowed from the bank. So each month with your principal payment you are paying down your loan which creates more and more equity as the months and years go on.

Interest

Interest payments on a loan are how the lender makes money over the life of the loan. You will pay more in interest and less in principal at the beginning of your loan term and as the years go on you will pay less in interest and more in principal payments. At first though you will get sticker shock on how much of your payment is going towards interest as opposed to principal. At closing you will be provided an amortization scheudle which will outline this horror show.

Taxes and Insurance

Your lender has a vested interest when it comes to you keeping current on your property tax and insurance payments. If you are late or default on either it puts both you and the bank at serious risk. How do they make sure the payments are made? They pay them for you. This is what is commonly referred to as “escrowing your taxes and insurance”. The cost of each is worked into your monthly mortgage payment.

Add up your principal + interest + taxes + insurance and that will equal your mortgage payment amount. You principal and interest payments combined will remain fixed throughout the life of your loan (as long as you have a fixed rate loan) and your taxes and insurance can fluctulate throughout the years depending on a number of factors.