Fully Executed Contract Date – This is the date the contract becomes official. The purchase and sale contract is not considered fully executed (official) until both sides sign. If you sign as the buyer on the 9th and the seller signs on the 10th your fully executed contract date is the 10th. A lot of the other dates in the contract bridge off this date so it is important to save your contract somewhere where you can easily refer to it.

Inspection Contingency Date – Assuming your contract has an inspection contingency this is where the amount of days you have to complete the inspection will be outlined. On most contracts you have a certain amount of days to not only get the inspection completed, but to also make a list of any repairs you want to request that the seller complete before closing.

Earnest Money Deposit Date

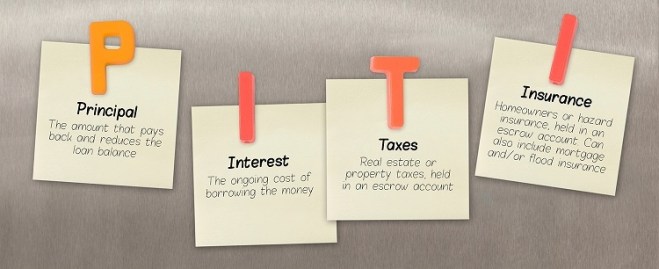

The earnest money is typically due to the sellers within 48 hours of the contract being fully executed. Earnest money is held in escrow typically by the sellers real estate brokerage, lawyer or title company until closing. At closing that money goes towards the buyers closing costs, prepaids, and escrows.

Mortgage Commitment Date

This is the date that the bank officially commits to lending to the buyer. They will issue a mortgage commitment letter that you will then give to the sellers in order to satisfy this part of the contract. Your lender should be well aware of the mortgage commitment date, but you may want to remind them of it when it is approaching so they can be on top of things. Typically the mortgage commitment date is 7-10 days before closing.

Closing Date

This is pretty self explanatory. The transaction closes on this date and the property officially changes hands from the seller to the buyer.